We have a soft spot for entrepreneurs at Nemphos Braue. Our founding members left some of the largest law firms in the world to build our firm in a way that allows us to be strategic partners to emerging companies to help them grow, rather than just be another outsourced, potentially expensive, resource. Our startup law series is designed to help entrepreneurs think through critical concepts for early stage businesses that can make or break your growth trajectory. Get started with this first post in our series on choosing which entity to form.

Entity formation and corporate structuring is a key part of positioning a startup for growth and success. Your business’ success is a marathon race, not a sprint. You wouldn’t start your marathon without the right running shoes, would you? Regardless of the type of structure you ultimately choose, the purpose of entity formation is to give your enterprise the proper foundation for success, as well as mitigate your personal liability as a founder.

Why entity formation?

Entrepreneurs who don’t opt to create an entity around their startup, are structured as a sole proprietorship. While this approach may be simpler, it means there is no protective separation between the founder as an individual and the business; the business’ liability becomes your own. This means that your house, your car, and all of your assets are on the line should your company stumble or fail. Further, a sole proprietorship does not give the entrepreneur the flexibility, nor the foundation to build an organization.

To mitigate this personal risk (and put on their running shoes), many founders opt to structure their businesses as a Limited Liability Company (LLC), a Partnership (PS), or a Corporation (INC), in order to create a protective cocoon around themselves and their personal assets, as well as creating the baseline from which they can run their marathon. Both entity structures provide limited liability, structure and flexibility for growth, but each comes with its own operational formulation.

Types of Corporate Structures

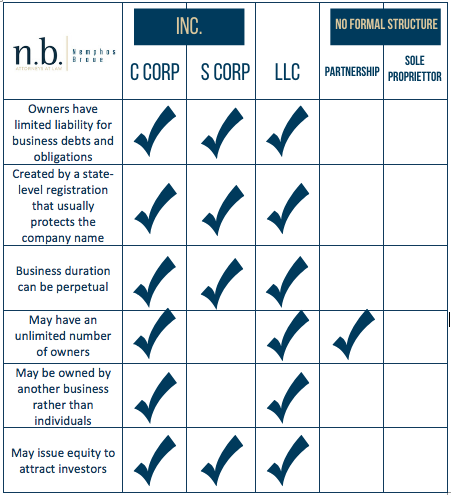

LLCs, Partnerships, and Corporations all have distinct advantages and disadvantages. From start up, to growth, to racing to the finish line, different stages of growth may require adjustment to your taxation or corporate structure (or both).

C-Corp: C-Corps, are a structure wherein owners are taxed separately from the entity, commonly referred to as “double taxation.” This is what you most commonly think of when you imagine a corporate structure. Instead of the founder assuming personal liability, the corporation is taxed on its own revenue separately from your personal income tax. Additionally, shareholders aren’t taxed until the corporation distributes funds to them. There can be benefits for taxation upon exit strategy with this structure.

S-Corp: S-corporations allow the business to pass corporate income, losses, deductions, and credits through to their shareholders for tax purposes. This means that as a founder you would report the company’s income (or losses) on your personal income tax, while still enjoying less liability than with a sole proprietorship.

LLC: A Limited Liability Company structure creates additional flexibility between partners, investors, and cofounders, compared to a corporation structure. An LLC is more or less a contract: a founder files articles of organization/certificate declaring the businesses status within the state. LLCs are often the choice of early stage startups pre-funding, as there are tax protections for founders as well as freedom in your operating structure. In addition to limited liability protections, LLCs also offer founders freedom to determine how distributions will be made to investors and how the LLC will be taxed: as C-Corps, S-Corps, or partnerships. For these reasons, an LLC may allow a founder additional opportunities for short and long term planning.

Which corporate structure is right for your business?

There are many factors to consider as you think about which corporate structure and approach to entity formation is right for your business.

Ultimately, choosing the right corporate structure for your startup is a personal decision that should be made based on numerous factors unique to your situation. There’s no one-size fits all training program for your marathon, but you can enlist the help of experts to ensure you’re as prepared as possible (and are sporting the right shoes for the job.)

How you structure your business can often be the difference between creating a runway for smooth sailing towards scaling your business, or navigating unforeseen financial obstacles. Learn more about how we work with emerging companies and startups to help entrepreneurs position their businesses for growth and long term success here.